The 15-Second Trick For Offshore Business Formation

Table of ContentsSome Of Offshore Business FormationSee This Report on Offshore Business FormationNot known Details About Offshore Business Formation The Offshore Business Formation StatementsGetting My Offshore Business Formation To Work

It is likewise worth noting that Hong Kong is ruled out a 'tax haven', and will not be affected by the (as it is already above the minimum). Hong Kong's tax system does not have any type of indirect taxes such as the Valued-Added Tax (VAT) or Goods and Services Tax (GST), such as those that use in the UK, the European Union, Australia, or New Zealand.

Offshore Business Formation Fundamentals Explained

When the Hong Kong offshore firm is included you will obtain from the Companies Computer system registry. As for, you have to register within one month from the consolidation of your new Hong Kong offshore firm - offshore business formation. Currently the Inland Revenue Department has set the "One-stop business and also company registration service", when a candidate provides the unification forms with the Business Registry will be taken into consideration to have actually made the application for the Company Enrollment certificate at the exact same time, conserving time for candidates.

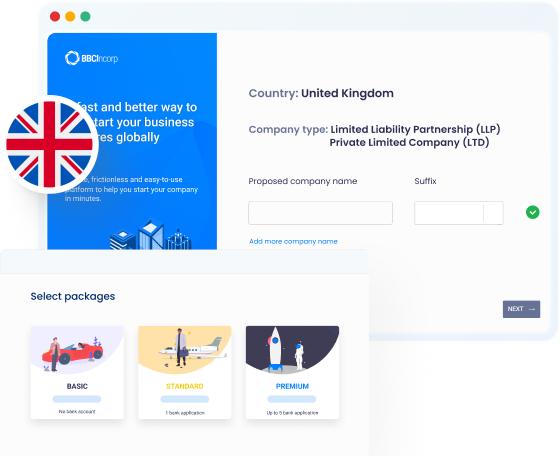

The city has a variety of solution companies in between conventional banking, online banks, and payment services that can offer a regional corporate bank account or service make up business integrated locally. However, each organization has a details particular niche of the marketplace they serve and internal needs for account application that can differ from one organization to one more.

If you wish to read more regarding the procedure of how to, You can visit our web page regarding to discover even more about the procedure of how to open a company account and also know more regarding the various alternatives readily available for overseas business - offshore business formation. It is very typical to confuse the term overseas business in Hong Kong.

Offshore Business Formation for Dummies

It is commonly thought about that the plain truth of including a business from another location will approve the company in Hong Kong the automatic right to be classified as an overseas company by the Inland Profits Division as well as have accessibility to the Revenue Tax obligation rate of 0%. offshore business formation. When providing Source a case to the Inland Profits Department business have to show their income source originates from jurisdictions outside of Hong Kong.

For instance, a company executing worldwide service sourcing in China and selling overseas. Is very typical that Chinese suppliers invoice to the Hong Kong company with another business in Hong Kong, in this case, the source of the earnings may be thought about from Hong Kong and also the firm most likely will not be provided the offshore standing.

In some scenarios there might be advantages in arranging for overseas company development and also share concerns for your business. Morgan Reach can aid with offshore formation services as well as share problems in numerous areas and also can additionally aid with overseas financial and also revivals. There are 2 primary reasons to develop an Offshore Business, Tax benefits, as well as legal security.

The Of Offshore Business Formation

Being one of the quickest creating on the world and also demonstrated to be probably the very best area to start a service, an offshore business development in UAE suits all fundamental as well as moved politeness for a company. offshore business formation. An overseas investigate this site firm development in Dubai can be asserted by people or corporate bodies and also is a business aspect that does not finish any kind of substantial business movement in its nation of creation.

Such a business is bordered under the no-tax territory regulation with the single factor for boosting one's treasures the board and also reducing any kind of tax installment lawfully. There are a few explanations behind offshore business joining UAE, with the crucial one being finished secrecy over the economic concerns and also increment in treasures without interference.

More About Offshore Business Formation

This exchange tax can be effectively kept a strategic range from offering the company itself. Not much residential or commercial property designers around the globe take into consideration more than a singular landowner. official website In case of an overseas business in UAE, be that as it may, the number of investors can be 1-50, and the company has the home.